Maximize Your Savings with a High-Interest Cooperative Society Interest Rates

In today’s fast-paced world, maximizing earning potential has become a priority for many individuals, as they constantly seek better interest rates. Moreover, some individuals are unhappy with their regular financial institutions, as they do not provide ideal interest rates to fulfill their goals, like daily needs and financial security.

That’s why many individuals from the national capital territory are now shifting towards the Delhi Cooperative Society savings interest rates. Such cooperative societies, like Samridh Samridh, offer better interest rates with an assurance of investment security. These cooperative societies are registered under the Delhi Cooperative Societies Act, 2003, which ensures the regulation and transparency of their movements.

Understanding the Working of Cooperative Societies

A cooperative society, such as Samridh Bharat, is built on the mutual financial goals of its members, which are the financial prosperity of the individuals.

Unlike the traditional financial institutions, which focus on making more money for their investors, a cooperative society works solely for the benefit of its members. Moreover, each society member gets similar voting rights, regardless of their investment amount.

When you put your money into a cooperative society, that money stays within the community. It is used to provide loans to your neighbors for small businesses, education, or home improvements. This creates a cycle of investment growth that benefits all members of the society.

In a regular financial institution, the hard-earned money of common individuals might be used to fund a massive corporate project far away. However, in a cooperative society, your savings are working to maximize the revenue for all the members of society. This “local first” approach is a big reason why many people feel a sense of pride when they invest their money in reliable cooperative societies like Samridh Bharat.

The Issues with Lower Interest Rates of Regular Savings

Traditional financial institutions often offer lower interest rates, which makes common individuals frustrated as they cannot achieve their financial goals with such rates. Moreover, the interest rates offered by such financial sectors cannot beat the rising inflation rate as well.

The inflation degrades the power of the money over the course of a regular savings account. For instance, money invested in a regular savings account at 4% interest rate will lose its value every year if the inflation rate is at 6%. Besides, if the cycle repeats for years, the money can potentially lose half of its purchasing power.

The individuals will have more money in their savings account, but they can buy fewer items with it. That’s how inflation gradually eats the value of the money.

An overview of Inflation affecting the regular savings in 5 steps:

Step 1 – 50,000 INR invested in a regular savings account at 4% annual interest rate.

Step 2 – After a year, the money will be 52,000 INR.

Step 3 – Let’s assume the inflation rate is at 6%.

Step 4 – The regular savings have actually lost 2% of their value, which is 3,000 INR.

Step 5 – Now the actual purchasing power of the money is 49,000 INR, even though you’ve 52,000 INR.

The Advantage of Better Interest Rates

One of the primary reasons why people switch to cooperative societies is the ideal return on investment (ROI). In a regular savings account, interest rates aren’t up to the mark, as they barely keep up with the rising prices of goods. However, many people find that the interest rates of a thrift and a credit society like Samridh Bharat offer more rewards for the average individual.

Even a small difference in percentage can add up to a significant amount over a few years. For a family that wants to achieve financial goals, such as a child’s wedding or a new vehicle, these high-interest rates make a real difference in how quickly they reach their target.

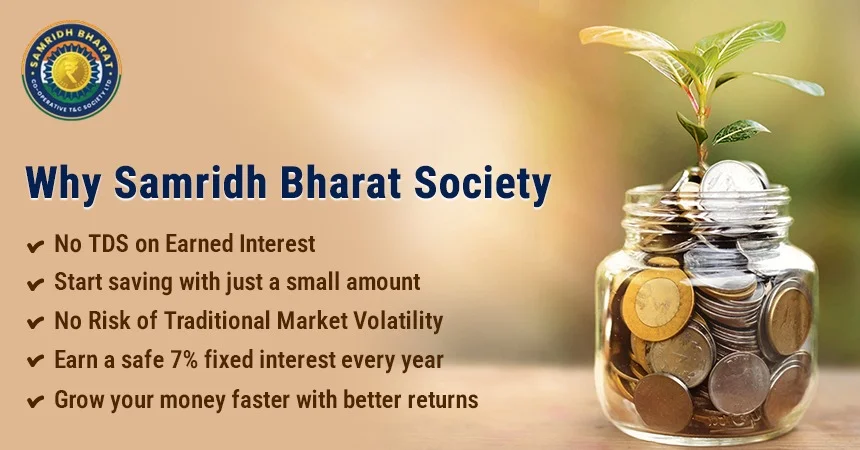

Why Choose Samridh Bharat?

Samridh Bharat Cooperative Thrift & Credit is one of the trustworthy cooperative societies in Delhi. It’s a member-focused organization dedicated to the financial freedom of its members.

It’s registered under the Delhi Co-operative Societies Act (DCS), 2003, and it operates with full transparency and legal compliance. Samridh Bharat focuses on providing financial well-being to common individuals through mutual cooperation.

Key Features of Samridh Bharat

Samridh Bharat Cooperative Thrift and Credit Society offers several features, which make it a better alternative to traditional financial institutions:

- Higher Returns: Individuals get a 7% annual interest rate on their savings account with Samridh Bharat.

- No Tax Deduction – There’s no tax deduction at source (TDS) on the earned interest on the savings account investment.

- No Volatility – Samridh Bharat isn’t associated with the market volatility. Therefore, the interest rates offered by them are fixed.

- Easy Loans – Members can opt for quick loans, small or big, in emergency instances without breaking the investment cycle.

- Transparency and Regulation – Samridh Bhart is registered under the Delhi Cooperative Societies Act (DCS), 2003, with the registration number 10844. It ensures an absolutely secure investment without any risks.

- Member-Focused – It’s a member-focused society, meaning all the benefits of the society are solely distributed among all of its members.

How to Become a Member of Samridh Bharat?

Joining Samridh Bharat involves straightforward steps that anyone can easily follow. The goal of such societies is to provide the future financial security to all of its members.

- Reach Out to Experts: You can reach out to Samridh Bharat experts on the call or pay an in-branch visit.

- Fill Out a Form: Complete a basic membership application form.

- Provide ID Proof: Submit government-issued IDs like an Aadhaar card, PAN card, and proof of address.

- Deposit Funds: Once the savings account is open, individuals can deposit money to earn high annual interest rates.

For more information or to join Samridh Bharat, call us at +91 9667847771. Alternatively, you can also send a message on WhatsApp at +91 966837771.

Final Thoughts

Choosing where to keep your money is one of the most important decisions for financial security. Moreover, choosing a reliable cooperative society like Samridh Bahrat is also crucial for assured returns on investments. It combines competitive returns with a focus on people and community values.

A good cooperative society will always be transparent regarding its operations. Members have the right to attend meetings and check the performance status of how the society’s finances are performing. This level of transparency is rare in traditional financial institutions.

FAQ’S

Q1. What are Delhi cooperative society savings interest rates?

Ans: Delhi cooperative societies generally offer higher savings interest rates than traditional banks. These rates help members earn better returns while maintaining security and transparency under the Delhi Cooperative Societies Act, 2003.

Q2. How do cooperative societies help beat inflation?

Ans: Cooperative societies provide higher interest rates that often exceed inflation. This helps preserve purchasing power over time, unlike regular savings accounts where inflation gradually reduces the real value of money.

Q3. Why are regular savings accounts considered less rewarding?

Ans: Regular savings accounts usually offer lower interest rates that struggle to match inflation. As a result, even though the balance increases, the actual purchasing power of the money declines over time.

Q4. What makes Samridh Bharat Cooperative Society in New Delhi trustworthy?

Ans: Samridh Bharat Cooperative Society in New Delhi is registered under the Delhi Cooperative Societies Act, 2003. It operates transparently, focuses on member benefits, and ensures secure returns on savings.

Q5. What benefits do members get with Samridh Bharat Cooperative Society?

Ans: Members of Samridh Bharat Cooperative Society receive higher interest rates, no TDS on savings interest, fixed returns without market risk, and access to easy loans for personal or emergency financial needs.

Q6. How can someone become a member of a cooperative society?

Ans: Joining a cooperative society usually involves submitting an application, providing valid ID and address proof, and depositing funds. Once enrolled, members can start earning higher interest on their savings securely.